Rounding numbers is a fundamental mathematical skill used in everyday life. Whether you’re dealing with personal finances, shopping, or even paying taxes, round to the nearest cent is a skill you’ll use frequently. In this article, we will explain what rounding to the nearest cent means, how to do it correctly, and why it’s important. We will also provide practical examples, tips, and answer common questions on this topic.

What Does “Round to the Nearest Cent” Mean?

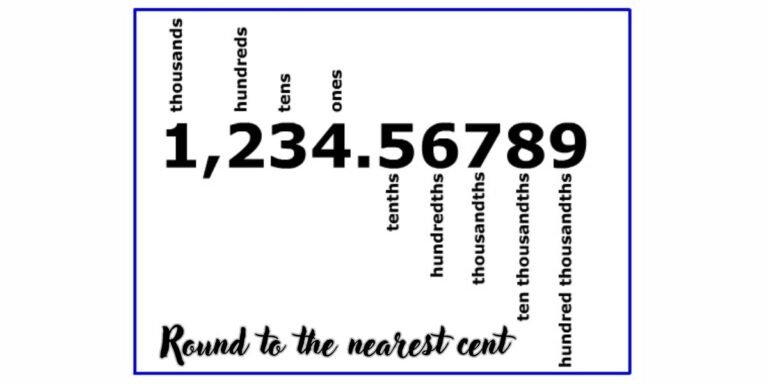

When you hear the term “round to the nearest cent,” it’s essentially about adjusting a monetary amount to the closest value of one cent (or two decimal places). In other words, if you’re given a number with more than two decimal places, you simplify it to just two decimal places, which is standard for currency.

For example:

- If you have $3.789, rounding it to the nearest cent gives you $3.79.

- If you have $4.992, rounding it to the nearest cent results in $4.99.

The general rule for rounding to the nearest cent is based on the digit in the thousandths place (the third decimal point). If this digit is 5 or higher, you round up. If it’s lower than 5, you round down.

Why is Rounding to the Nearest Cent Important?

Rounding to the nearest cent is crucial for several reasons:

- Financial Accuracy: Most financial transactions are done in cents, and businesses often round prices to the nearest cent. Rounding ensures that calculations like bills, taxes, and change are accurate and manageable.

- Tax Calculations: Many tax systems require rounding to the nearest cent. For instance, sales tax on an item may not be an even number, so rounding is necessary to calculate the exact tax owed.

- Ease of Payment: When making purchases or calculating balances, rounding simplifies the math. It’s easier to work with figures like $5.75 than a long decimal number like $5.74682.

- Consistency: Rounding ensures consistency in financial statements and records. Whether you’re tracking personal spending or preparing an invoice, consistency helps in understanding your finances.

How to Round to the Nearest Cent: Step-by-Step Guide

Rounding to the nearest cent can be done using the following simple steps:

- Identify the Thousandths Place: This is the third decimal place (after the decimal point), which helps you determine how to round.

- Look at the Thousandths Place:

- If the digit in the thousandths place is 5 or more, round up the hundredths place by one.

- If the digit in the thousandths place is less than 5, leave the hundredths place as it is.

- Adjust the Number: After rounding, drop all digits after the hundredths place (the second decimal place).

For example:

- $4.756 → The thousandths place is 6, so we round up the hundredths place to 6. The result is $4.76.

- $3.233 → The thousandths place is 3, so we leave the hundredths place as 3. The result is $3.23.

Rounding to the Nearest Cent in Different Scenarios

Here are some practical examples to help clarify how rounding to the nearest cent works:

Shopping and Purchases

When you buy something and the price isn’t an exact amount, the store typically rounds to the nearest cent. For example:

- A sweater costs $29.967. Rounding to the nearest cent, it would cost $29.97.

- A book costs $19.991. Rounding gives you a price of $19.99.

- Calculating Tip

When leaving a tip at a restaurant, the amount often includes rounding. If the bill is $47.386, and you want to leave a 15% tip:

- 15% of $47.386 is $7.108.

- Rounding the tip to the nearest cent gives $7.11.

- Banking and Investments

In finance, rounding is used for transactions such as interest calculations or dividends. If the interest on your savings account for a month is calculated as $12.745, it will be rounded to $12.75.

Common Mistakes to Avoid When Rounding to the Nearest Cent

While rounding may seem straightforward, it’s easy to make mistakes. Here are some common pitfalls to watch out for:

- Incorrectly Rounding Up or Down: Always check the thousandths place to determine if you should round up or down. If it’s 5 or more, round up; if it’s less than 5, round down.

- Forgetting to Round: Sometimes, calculations may involve longer decimal numbers, and forgetting to round them can result in inaccurate totals. Always check if the number is in the correct format (two decimal places) after rounding.

- Rounding Too Early: When doing multiple calculations, avoid rounding until the final step. Rounding too early can lead to cumulative errors, especially in larger sums or interest calculations.

Conclusion

Rounding to the nearest cent is an essential skill in managing your finances and ensuring accuracy in daily transactions. Whether you are shopping, calculating taxes, leaving tips, or managing bank accounts, knowing how to round to the nearest cent simplifies your calculations and ensures consistency. Remember to follow the basic rule: if the thousandths place is 5 or more, round up; otherwise, leave it as is. By practicing this simple rule, you’ll be able to handle any financial situation with ease and precision.

FAQs About Rounding to the Nearest Cent

What is the rule for rounding to the nearest cent?

The rule is simple: look at the thousandths place (third decimal). If the digit is 5 or more, round up the hundredths place by one. If it’s less than 5, leave the hundredths place as it is.

Why is rounding important in financial transactions?

Rounding ensures that financial figures, like bills and taxes, are manageable and accurate. It helps prevent errors in calculating payments, taxes, and tips.

Can I round before adding amounts?

It’s generally best to round only after completing all calculations to avoid cumulative errors.

What if I get a long decimal with many digits after the decimal?

If you get a long decimal, focus only on the first three digits after the decimal point. The first two digits will be your rounded figure.

Is rounding the same for all currencies?

Yes, rounding to the nearest cent is common for most currencies like dollars and euros. However, some currencies may use smaller units, such as fractions of a cent or other subdivisions.